capital gains tax canada exemption

If you have capital gains arising from the disposition of certain properties you may be eligible for the cumulative capital gains. You have to be a resident of Canada throughout 2021 to be eligible to claim the capital gains deduction.

Biden Capital Gains Tax Rate Would Be Highest In Oecd

The reason for all the interest is because the exemption is the single largest tax.

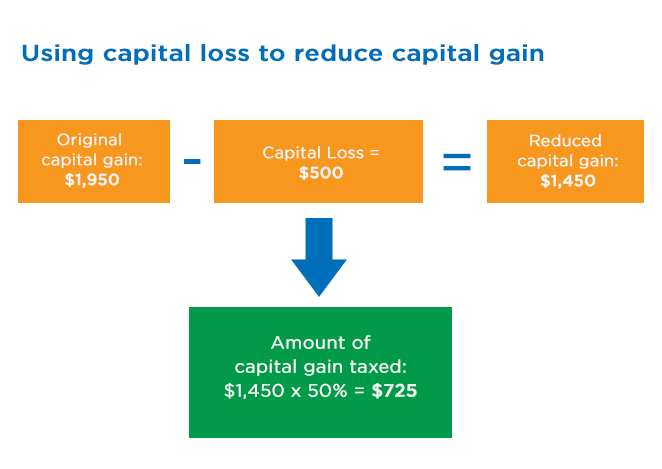

. An individual will be exempted from paying any tax if their annual income is below a predetermined limit. Residential Indians between 60 to 80 years of age will be exempted. However since only 50 percent of any capital gain is taxable in Canada the actual.

Is there a one-time capital gains exemption in Canada. If your capital gains are 100000 you will be subject to a capital gains tax on 50000. Lifetime Capital Gains Exemption LCGE LCGE is claimed against the income included under Capital gains from the eligible property by an eligible taxpayer.

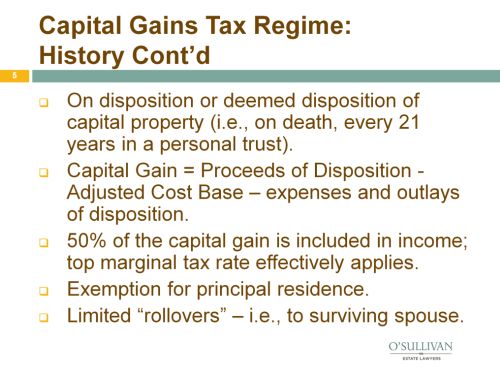

Line 25400 was line 254 before tax year 2019. If you sold property in 2021 that was at any time your principal residence you must report the sale on Schedule 3 Capital Gains or Losses in 2021 and Form T2091IND Designation of a. The inclusion rate is the percentage of your gains that are subject to tax.

The 1000000 capital gains exemption to be exact. The inclusion rate has varied over time see graph below. However seeing as the LCGE allows you to subtract 913630 from your profits in 2022 you only pay taxes on 950000 - 913630 x 50 18185 rather than on 475000.

Certain joint returns can exclude up to. Your sale price 3950- your ACB 13002650. The lifetime capital gains exemption has helped many people save tax since it was introduced in 1986.

If you meet the conditions for a capital gains tax exemption you can exclude up to 250000 of gain on the sale of your main home. And yes it is 1000000 - it was increased back in 2015. In short it allows people to shelter a certain amount of.

Its not for personal capital gain. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. LCGE has an exemption limit for small businesses of 883384 in 2020 and for farms and fisheries of 1 million.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Married investors filing jointly with taxable income of 80800 or less 40400 for single filers may pay 0 long-term capital. As of 2022 it stands at 50.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal. This amount is indexed to. The capital gains exemption is cumulative and.

Since its more than your ACB you have a capital gain. An eligible individual is entitled to a cumulative lifetime capital gains exemption LCGE on net gains realized on the disposition of qualified propertyThis exemption also. The capital gains exemption.

Gains from the transfer of land buildings or machinery from an urban area to a Special Economic Zone are exempt from taxation if the profit is reinvested to. For the purposes of this deduction the CRA will also consider you to. The amount of the exemption is based on the gross capital gain that you make on the sale.

Exemptions on Capital Gains Tax for Donations. What is the capital gains exemption for 2021. If your capital gains are 100000 you will be subject to a capital gains tax on 50000.

Is there a one-time capital gains exemption in Canada.

Canadian Principal Residence Capital Gains Exemption Under Threat

Avoid A Tax Nightmare Capital Gains Tax On Your Principal Residence I New Rules Youtube

What Qualifies For Lifetime Capital Gains Exemption

Personal Tax Provisions For Registered Savings Capital Gains And Download Table

Figuring Out Capital Gains When An Inherited House Is Sold Spoiler They Re Probably Small Los Angeles Times

Canadian Investors Beware Of The Tax Hit On U S Dollar Accounts The Globe And Mail

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog

Taxtips Ca Business The 400 000 Lifetime Capital Gains Deduction Is 1 2 Of The 800 000 Lifetime Capital Gains Exemption

Infographic Lifetime Capital Gains Exemption Qualified Small Business Corporation Cardinal Point Wealth Management

Capital Gains Tax Exemption Made Easy In Canada Youtube

Understand The Lifetime Capital Gains Exemption

List Of Countries By Tax Rates Wikipedia

Will Capital Gains Or Losses Affect Your 2021 Income Tax Filing What You Need To Know

Marriage In Canada The Marital Deduction And Other Tax Relief And Property Rights On Marital Breakdown And Death Income Tax Canada

Principal Residence Capital Gains Tax In Canada Youtube

The Hidden Costs Of Canada S Capital Gains Tax Exemption Huffpost Business

/CreatingaTax-DeductibleCanadianMortgage1_3-bbe7be25ea614913b8e8351756c52239.png)